Building digital assets is a process by which an organization can create a reusable piece of digital content and make it accessible within an organized system. In today’s digital age, this type of content is vital to business and marketing efforts. One example is a digital presentation. Usually organized in a series of cards in a horizontal layout, a digital presentation can be a vital part of a sales pitch. A creative agency bidding for a client project may create a deck to showcase its work and budget.

Financial institutions are building digital assets

The digital asset market is expanding rapidly and will soon be intertwined with different aspects of the economy. Traditional financial institutions are exploring adjacencies with this ecosystem and must understand the emerging risks. They must also create separate insurance programs to handle these new risks. Here are three ways that these institutions can ensure the safety and protection of their digital assets.

In recent years, the global digital assets market has grown dramatically, with millions of investors purchasing digital assets worldwide. Last November, the market capitalization of cryptocurrencies surpassed $3 trillion. Investing in digital assets presents a significant opportunity for financial institutions as they seek to remain competitive. However, digital assets still pose risks, such as the crash of stablecoin in May. Investors and consumers lost more than $600 billion due to the collapse.

One of the biggest challenges facing the industry is regulatory uncertainty, the current administration issued an executive order encouraging responsible development of digital assets. Furthermore, a bipartisan crypto bill has recently been introduced in the U.S. Senate.

However, these institutions must first understand the types of assets they want to protect. There is a risk of loss of confidentiality when holding digital assets, and they must maintain strong internal controls. They must also be aware of the terms and conditions associated with various platforms. Lastly, they must have adequate compliance and due diligence measures in place.

The adoption of digital assets is increasing. Experts predict that by the end of 2021, there will be nearly $2 trillion in the digital assets market. Although the popularity of digital currencies has been primarily among enthusiasts, retail investors are increasingly turning to digital assets. Millennials, high-net-worth individuals, and family offices are the primary groups seeking these assets. This growing interest in digital assets is driving the demand for new custody services.

Data aggregation and normalization

Aggregation and normalization are two processes necessary to build a digital asset. Aggregation involves compiling data from multiple sources and transforming it into a common format. The data is then normalized to make it accessible for machine-learning algorithms. Normalized datasets are more informative for machine-learning algorithms than those that contain data that is not structured.

Data normalization helps companies and organizations make the most of data. It makes it easier to query data across multiple sources, which saves space, time, and money. The process will differ depending on the type of data. In general, the process involves removing duplicate entries and organizing the data into a logical format.

Aggregation can be done manually or through a software platform. In either case, it begins with the preparation of raw data from a data source. This preparation may involve locating, transporting, and normalizing the data. Once the data is ready, the aggregator applies an aggregate function to it. This transformed data can then be handled further or saved in persistent storage. Afterwards, it may provide the data to other processes for further analysis.

Data aggregation and normalization are two important steps in building a digital asset. Aggregation of data makes it easy to build lists with valuable information. Aggregation and normalization can help businesses analyze their data and make informed decisions based on that information. Data normalization allows businesses to sort groups into categories based on industries and titles. In addition, data normalization makes data easier to use by allowing for quick grouping and categorization.

Creating data warehouses for digital asset aggregation is essential to making the most of the potential of digital assets. It allows them to make more informed decisions about the value of a particular asset. It also makes it easier to understand which assets are performing better.

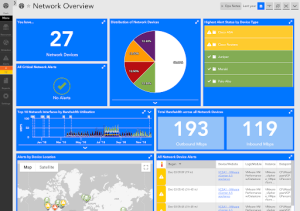

Reporting on digital asset activity

There are many challenges associated with reporting on digital asset activity. One of the biggest is ensuring that the vendor provides sufficient and adequate detail. Many digital asset vendors rely on sub-service providers for a number of different services. These services may include hosting, SaaS platforms, and physical security. It is important to determine which sub-service providers offer the best reporting capabilities.

To effectively report on digital asset activity, you must collect data from different sources. Data from exchanges, custodians, wallets, and protocols is gathered by companies to gain a comprehensive view of the asset’s activity. These data sources can be large and complex, and should be aggregated and normalized for a holistic view of the asset’s activity. In addition, these assets are often operating around the clock, so it can be difficult to keep up with the amount of information.

The SEC has the authority to regulate digital asset securities. The agency can also regulate exchanges and brokers that deal in these digital assets. In this way, the agency can protect investors, protect consumers, and prevent money laundering and tax evasion. Further, regulators have the power to enact new laws and enforce existing ones.

The SEC’s authority over digital assets and the associated market infrastructure must be fully exercised. The current volatility of the market is also a potential risk for compliance with these regulations. Therefore, organisations should be vigilant when building digital assets. They should ensure that they have proper reporting procedures in place to ensure they meet the requirements of the SEC.

The key to building a digital asset is to ensure that the digital asset is backed by a reasonable expectation of profits. Profits can be realized through capital appreciation, distributions, or selling on the secondary market.

Lending platforms replace intermediaries

Digital lending platforms can provide certainty and reduce cost in the process of building a digital asset. These solutions are based on a Digital Original, which has a digital chain of custody and is transferable and enforceable. Additionally, these solutions come with analytics and reporting tools to ensure compliance and analyze risk. This helps make better decisions and improves efficiency and profitability.

As more financial institutions enter the digital asset space, they are turning to blockchain technology. Many of these projects use the distributed ledger technology to build smart contract-based lending applications. These platforms replace intermediaries and are a great way to increase liquidity in crypto assets. Some of these platforms use prediction markets and liquidity mining to earn interest, fees, and additional tokens.

To fully benefit from the potential of these assets, banks and financial institutions must collaborate closely. This includes fintech providers, traditional asset owners, and service providers. These firms also need to have a scalable, transparent platform. They need a solution that can support a broad range of digital assets and help them meet their regulatory and technological obligations.